Cutting Through the Red Tape ... Your Complete Customs Broker

Request a Free Estimate!

Services

Let us help you sort out the red tape on your international packages in West Palm Beach.

About Us

We’re a family-owned and -operated business and with more than 30 years in the business.

Online Resources

When it comes to processing your paperwork, we know what to do to take care of all your needs.

Locations

If you’re looking for experts in customs broking, look no further than Dolphin Brokerage International.

Contact Us

Contact the experts at Dolphin Brokerage International for a free, no-obligation estimate today!

Dolphin Brokerage International

1556 N Congress Ave.

West Palm Beach, FL 33409

Phone:

561-683-2064

Email:

tvaughan.dolphin@gmail.com

Business Hours:

Monday-Friday, 8 a.m.-5:30 p.m.

Saturday-Sunday, Appointments Only

Free Estimates

Free Consultation

Licensed

YP Reviews

Your feedback is important!

Reliable Customs Brokers in West Palm Beach

With more than $73 billion dollars in merchandise exports (for the year 2015) and as a gateway for countries to get a foothold in the United States market, importing and exporting goods is a large part of Florida’s economy. With so much diversity in the market, it’s no wonder that people and businesses need the assistance of customs brokers to help them navigate the legalities of their businesses.

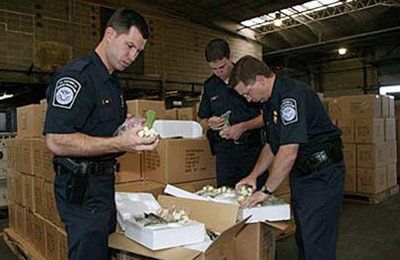

Here at Dolphin Brokerage International, we cut through the red tape for you as your complete customs brokers, by submitting any necessary information or payments on your behalf.

Our Expertise

As international customs brokers, we’ve found that it’s both necessary and helpful to have an expertise in a wide variety of shipping areas.

Entry Procedures

This is the paperwork and verifications procedure in place for reporting imports and exports to U.S. Customs and Border Protection (CBP).

Admissibility Requirements

These are the conditions under which goods can enter the country. It can include requirements on the marking, labeling, content and safety of crates. For example, it may be legal to import only a certain amount of a good. In order to meet admissibility requirements, you have to only import that legal amount.

Classification

International imports and exports

prescribe to a system of classification known as the Harmonized System. This helps participating countries classify goods using a number in order to simplify trade between countries. This was implemented by the World Customs Organization to engender uniformity.

Valuation

This is the procedure by which a customs value is placed on goods. If the rate of duty for the goods is ad valorem, meaning that it’s based on the value of the transaction or property, this can be an essential part of deciding the duty to be paid on the good.

Rates of Duty

A customs duty is a tax imposed on international goods to protect each country’s economy by controlling the flow of goods. The rate one has to pay for this tax is generally decided on using the Harmonized System, since it’s often based on a good’s classification.

Other Applicable Taxes and Fees

Customs duties aren’t the only taxes or fees that you may have to pay on your imported goods. There are others as well.

Get Started

For help understanding all the various customs legalities, call Dolphin Brokerage International. Our experts

will walk you through every step of the process.

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy